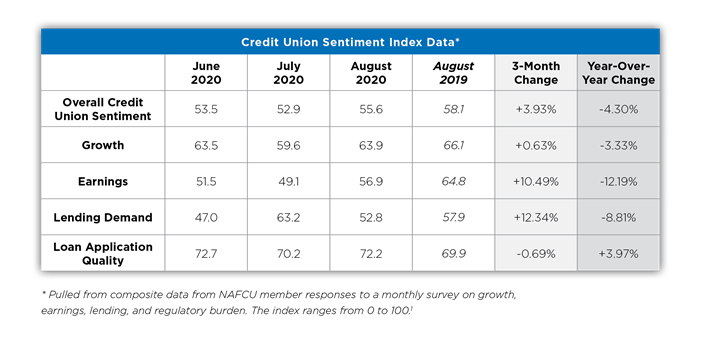

As the chart above indicates, things appear to be looking up for credit unions. However, it is yet to be determined whether these growth indicators will continue their upward trajectory in the coming months and into 2021.

The COVID-19 pandemic continues to impact the U.S. economy; many people remain out of work and others remain extremely cautious about how and where they invest and spend their money. Many credit unions are continuing to offer temporary loan forgiveness and deferral programs to support members’ financial needs, making it difficult to predict default and delinquency rates upon termination of these programs. Given these and other factors affecting the economy, it remains quite difficult to determine the outlook for credit unions beyond the pandemic.

Regardless of these unknowns, there are steps your credit union can take today to ensure stability and growth now and into the future.[1]

- Mitigate Lending Risks

Credit unions will need to prepare for a significant increase in loan default risks, which some predict will increase by as much as 25-50% by late 2020 or early 2021.[2] These loss exposures are predicted to increase as temporary loan relief measures continue to expire, and as loan payments and collections activity return to normal.

Alternative protection solutions (such as life insurance, debt protection, and loan refinancing options) can support your members’ financial stability and protect against these coming lending risks. Offering these solutions presents an opportunity to increase sales penetration, drive revenue, and deepen the relationships between credit unions and borrowers. Credit unions should also consider robust, member-first risk management programs to track, report, and handle collateral recovery and response more effectively. - Enhance Digital Services

Aside from economic disturbances, arguably the most powerful impact the COVID-19 pandemic had was the abrupt transition from in-branch to remote operations. For quite some time, credit unions have faced a growing need to evolve their digital strategies.

There are many ways credit unions can leverage digital opportunities to enhance relationships with their members and create long-lasting value beyond COVID-19. Credit unions should consider how they can build on their current digital service and communication strategies to enhance their member and business strategies.

Research studies have come out demonstrating the direct correlation between digital banking and consumer satisfaction. In one such study produced by Provident Bank in 2019, 82% of the surveyed respondents said they were less likely to switch financial institutions if they like and become accustomed to their digital banking services.[3] Developing a strong, effective digital strategy certainly comes with challenges, but putting in work now can have a rewarding payoff for credit unions. - Expand Loan Offerings

Regulations, competition, and liquidity all play major roles in a credit union’s lending strategy. Today, consumers are receiving loan offers from various organizations (through various channels) promising to give them loans perfectly suited to meet their needs. For this reason, consumers are no longer looking at traditional loans as their only option.

Expanding loan portfolios beyond traditional offerings will enable credit unions to meet market demands while continuing to bring in safe, profitable loans. Non-traditional solutions offering refinancing opportunities, rate adjustments, or payment flexibility are of special interest to today’s financially cautious, risk-averse consumers looking to take on a new loan. Competitive solutions offer borrowers the opportunity to pay back their loans in ways that fit their lifestyles and financial needs, while helping credit unions differentiate themselves with more diverse offerings that can grow loan profitability, and diversify their portfolios.

Even without knowing the full impact the pandemic will have on the marketplace, it is safe to say it has exaggerated and accelerated – and will continue to exaggerate and accelerate – many of the growth and risk challenges that already existed for credit unions. Now is the time for your credit union to assess and evolve your growth, risk, and member strategies to remain competitive.

[1] www.nafcu.org/research/ECUIMonitor

[2] www.nafcu.org/consumerbehavior20webinar

[3] www.prnewswire.com/news-releases/provident-bank-survey-shows-three-fourths-of-us-adults-prefer-digital-bankingservices-300948161.html