Cutting Through the Fraud: How Video Marketing Combats Tax Scams

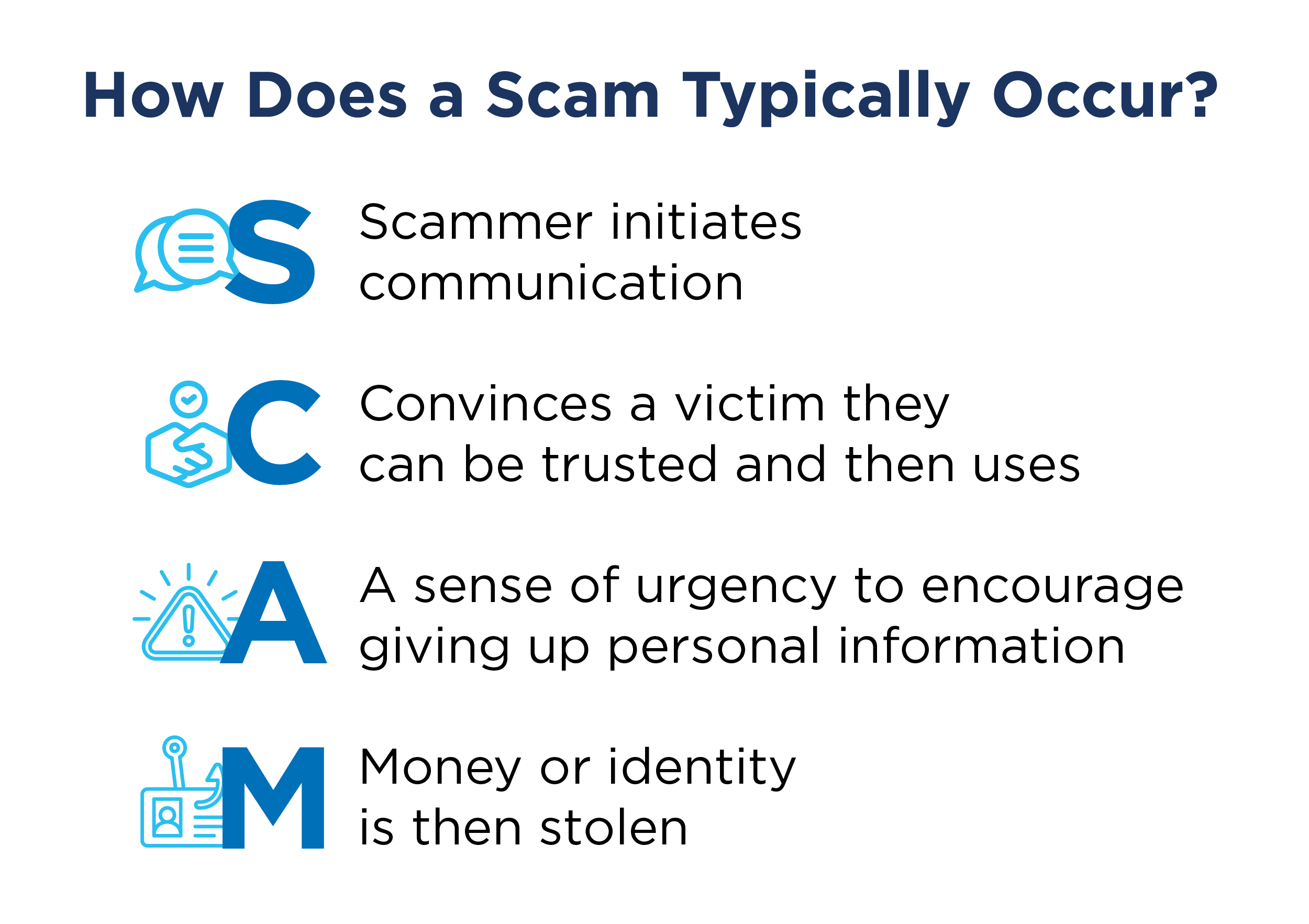

The Internal Revenue Service (IRS) recently announced the Dirty Dozen, the top 12 scams individuals and businesses should watch out for during the 2024 tax filing season. This year, one of the most concerning scams involves cybercriminals posing as tax professionals accepting new clients. Typically, the fraudster contacts victims while impersonating an IRS or state tax authority employee, claiming to assist with tax filings or demanding payment for overdue taxes. These fraudulent communications, sent via email or text, often include a fake tax service name and may direct recipients to a deceptive website designed to appear official.

Amid the rush to meet tax deadlines, comes the increase of fraud attempts and tax scams as well as new challenges with changes under the new administration. Adjustments in tax filing requirements can make taxpayers especially vulnerable to certain types of fraud.

Alarmingly, 34% of American adults reported falling victim to financial scams in the past year. Tax scams continually evolve as fraudsters devise new, innovative ways to deceive taxpayers. This year, scammers are notably leveraging generative AI to craft convincing, error-free content for more sophisticated phishing and smishing scams.

By proactively sharing timely information about these scams with your employees and accountholders, you can significantly reduce the risk of them falling victim.

Prevention Tips to Keep Accountholders Safe from Tax Scams:

- Exercise Caution with All Communication

Any communication requesting personal or financial details—tax-related or otherwise—should be treated suspiciously. Remember, the IRS and state tax authorities never initiate contact via phone, email, text, or social media. - Scrutinize Payment Requests

The IRS never demands payment via prepaid debit cards, gift cards, or wire transfers. - Report Threatening or Aggressive Messages

Calls demanding immediate payment or threatening legal action are almost always fraudulent. Official tax authorities send initial notices through mail before contacting you by other means. - Watch for Duplicate Filing Issues

If your e-filed tax return is rejected due to a duplicate EIN/SSN already on file or you receive an unexpected tax transcript, this could indicate identity theft.

To further protect employees, encourage them to safeguard their W-2 forms, as these are highly targeted by identity thieves who use them to file fraudulent tax returns. Use video training sessions to educate staff on recognizing tax scam warning signs, detecting potential scams, and responding appropriately if they suspect identity fraud. Training staff is equally as crucial as educating accountholders, ensuring everyone is equipped to detect and report threats effectively.

Would you be surprised to learn that video is the most effective way to raise awareness about tax scams? Probably not.

Explainer videos simplify complex subjects, making them both easy to understand and engaging—and creating them doesn't have to be complicated.

With the right tools, your team can quickly produce impactful videos in-house, while:

- Eliminating the need for voice actors, directors, or scriptwriters

- Cut video production time by 75%

- Boost engagement with personalized content

- Educate employees and accountholders effectively on fraud prevention

SundaySky, powered by Allied Solutions, allows you to create professional, branded explainer videos in under an hour.

Watch a sample video now:

No matter which new scams emerge or how political changes affect tax regulations, it’s critical for your financial institution to consistently communicate relevant, actionable information with accountholders and employees. Leverage the power of video communication across multiple channels to strengthen trust and share timely fraud prevention strategies.

Get real-time fraud risk alerts straight to your inbox. Sign up now.