New and evolving market pressures are quickly and aggressively elevating the need to gain a well-founded understanding of your consumers’ current and future wants, needs, and habits. These market pressures include:

- The growing number of competitors seeking the business of your consumers, namely Fintech and retail banking platforms like Amazon’s emerging service.

- The emerging need to comply with CECL’s new accounting and requirements, which require the data-backed support of any credit loss predictions.

- The shifting buying habits and service expectations of key consumer demographics, namely the more digitally-inclined Millennials.

Leveraging the right data will help you to better understand the needs of your business and consumers, which in turn will vastly improve your efforts to overcome growing market pressures, such as those mentioned. The “right data” includes the following:

- Tier 1: Enterprise data pulled from the systems across your organization

- Tier 2: Engagement data compiled from the many channels your consumers interact with

- Tier 3: Partner data received from vendors and providers

- Tier 4: Collaborative industry data insights supplied by open, collaborative data sources that pool and analyze peer and industry data

Let’s dig into how exactly these different “tiers” of data build on each other to elevate your understanding consumers and enhance your business strategies.

Tier 1: Enterprise Data

Primary Objectives:

- Unlock consumers’ transaction details across all your systems to identify your most profitable consumers, flag your at-risk consumers, and uncover new revenue and pricing opportunities.

- Streamline business operations by connecting systems that did not traditionally “talk” to one another through a single, enterprise-wide data language.

Data Source Examples:

- Source transaction details across all your systems, including:

- Loan origination systems

- Insurance tracking systems

- Core processors

- Payment processors

- Master customer information files (MCIFs)

- Customer relationship management systems (CRMs)

Sample Scenario:

Through setting up a communication between all of your operational systems, you uncover that Jane Doe is an active user of her credit card and has an auto loan through your financial institution. You also see that she manages to make her credit card, insurance, and loan payments on time every month. With this unlocked information, you can build a strong case that Jane would be a good, safe candidate for future loan and card offers.

Tier 2: Engagement Data

Primary Objectives:

- Connect data from all consumer touchpoints to strengthen your understanding of interactions and build a 360 view of their financial and service habits and needs.

- Uncover opportunities to optimize user experiences across all devices and channels to engage new consumers and win back disengaged consumers.

- Identify patterns in consumer behaviors to predict future outcomes and prevent risks in real time.

Data Source Examples:

Source all possible consumer touchpoints to compile interaction, transaction, and engagement data across these various channels. These touchpoints include:

- Customer service chat and call logs

- Email and newsletter interactions

- Marketing engagement

- Mobile app interactions

- Social media engagement

- Website interactions

Sample Scenario:

You find multiple call logs between your service center and John Doe where he asks about payment extensions and late payment penalties more than once. From this information, you conclude that John might miss one or more future loan payments and is worth watching.

Tier 3: Partner Data

Primary Objectives:

- Leverage strategic partnerships to access a larger pool of consumer data beyond that which you have access to inside your organization.

- Combine datasets from product providers and partners to gain a deeper, more accurate view of your consumers, and business challenges.Increase relevance of consumer marketing and sales efforts to improve sales results and increase wallet share.

- Enhance your understanding of demographic targeting for next best product offers based on buying habits.

- Advance your ability to identify and predict risks based on an expanded view of consumers’ claim and/or payment histories.

Data Source Examples:

Pull consumers’ payment, transaction, claims, and purchase histories from providers, such as:

- Insurance agencies

- Card processors

- Insurance tracking providers

- Remarketing and recovery service providers

Sample Scenario:

Johnnie Roe has submitted an online application for a loan and you are suspicious of some of the information he provided. Through access to your product providers’ records, you uncover Johnnie Roe has been flagged as a fraud risk with more than one provider. You decide to deny the loan and ask that he come into a branch to complete the process saving yourself from the potential fraud risk.

Tier 4: Collaborative Industry Data

Primary Objectives:

- Join with organizations industry-wide to gain access to larger data than that which is possible if you were to remain on your own data island.

- Harness the same level of consumer data as big banks, Fintech, and large retailers (i.e. Amazon and PayPal) through leveraging insights provided by collaborative analytics.

- Enhance consumer interactions, reduce costs, improve operations, and automate transactions through access to data and insights shared by organizations.Benchmark performance against other financial institutions.

- Cost-effectively share information with other organizations in the industry via easily accessible pre-built reports and dashboards.

Data Source Examples:

Pull from pre-built reports and apps that supply insights, analytics, and comparative data from the industry at large. These include, but are not limited to:

- Predictive analytics

- Compliance-related reporting (e.g. – CECL)

- Dashboards

- Risk pool analysis

- Employee productivity

- Fraud detection

- Consumer segmentation

Sample Scenario:

ABC Credit Union leverages OnApproach’s collaborative analytics platform to access custom, plug-and-play reports that pool from industry-wide data. From use of the platform the credit union gains brand new insights on consumers’ buying habits while also receiving consultation on how they could leverage the new information to enhance their relationships with new and existing consumers. This leads to an instant lift in ABC CU's membership.

Tying it All Together

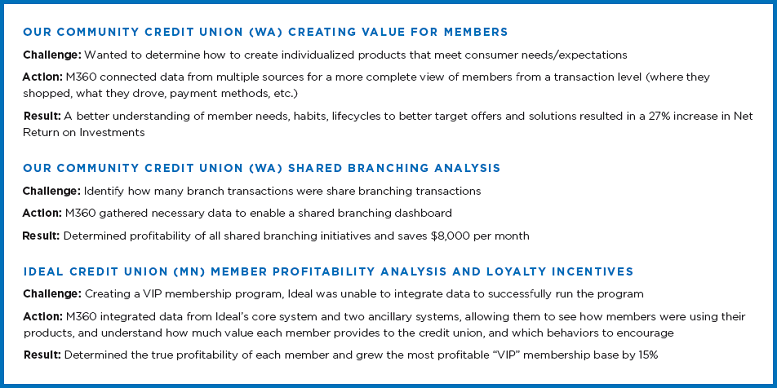

Below are some real examples of financial institutions that leveraged this four-tiered approach through OnApproach’s M360 enterprise to achieve identified business goals:

If you aspire to provide Amazon levels of consumer experience, then you need to take this four-tiered approach to compiling and leveraging data. Only then can you build business strategies that you know with relative certainty will enhance relationships with new and existing consumers and grow your business.

Read “The Digital Train Is Leaving the Station: Are You On It?” to learn more on evolving your business strategies.

Contact us to learn more about our collaborative data management platform.