New Podcasts Address Trending Fraud Crimes

This content was originally posted by NAFCU Services.

Fraud exposures continue to plague our industry, many of which are tied to the expanded use of remote transaction channels. And with COVID-19, these crimes have only gotten worse.

Randy Salser, President of NAFCU Services, interviewed Ann Davidson, VP of Risk Mitigation at Allied Solutions, for two editions of The CU Lab Podcast to speak about some of these growing crimes: HELOC fraud, online fraud, and mobile fraud.

What’s the deal with HELOC Fraud?

As Ann said in our recent podcast recording, HELOC fraud crimes pose a potentially expensive fraud risk to credit unions, sometimes resulting in as much as six figure losses. Fraud criminals are aware of the fact that these open-ended loans can offer a lot of financial gain. They also know these loans are often not monitored as closely as an auto loan, mortgage loan or credit card loan, and are therefore easier targets for an undiscovered attack.

HELOC attacks performed via remote channels have ramped up during COVID-19. Ann advised credit unions take extra steps to review their controls surrounding HELOCs to prevent these dangerous attacks. Tune in to the podcast below on “How to Deter HELOC & Loan Fraud Attacks” to learn more about how these crimes take place and hear strategies for mitigating these crimes.

What’s going on with Online and Mobile Fraud?

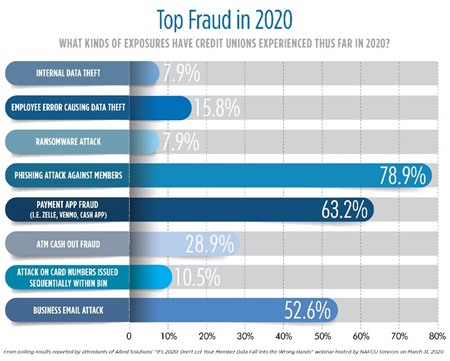

As the graphic indicates, many credit unions have already experienced some kind of digital fraud attack in 2020, and the pandemic has only made these exposures worse.

While offering online and mobile solutions creates high value for credit unions and members, these channels can also open up new opportunities for fraud unless properly protected.

Ann stated there are a number of digital fraud crimes impacting credit unions and members today. The most popular among these include: email/phishing scams against members and businesses, remote deposit fraud, and attacks on payment app apps.

The best ways to prevent these crimes: educate members and staff about these crimes, implement proactive controls, and enforce extra authentication measures. These methods can be a lethal combination for preventing these fraud crimes. Listen to the podcast below on “Tips to prevent Online & Mobile Payment Fraud” to hear more about detecting and preventing attacks.