SIGN OF THE TIMES BLOG SERIES PART 1 — BANKING WITHOUT BORDERS

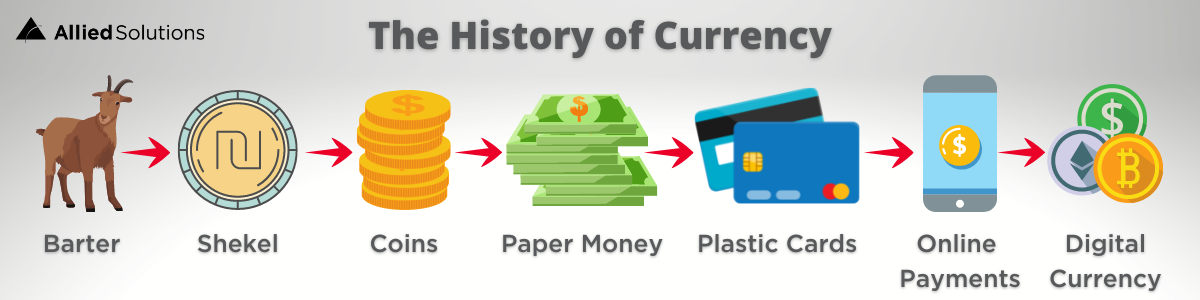

There’s a long history of trade in both goods and currency alike, but these exchanges have taken on many forms over time. The invention of currency allowed people to trade goods and services without having to barter to arrive at an appropriate price. Since its inception, conveniences continue to emerge and evolve over time through technology advances resulting in global usability.

The Changing Forms of Exchange

Before any concept of money existed, people bartered goods and services for what they needed. Lumber for livestock as a more direct exchange, or sometimes, seeds were borrowed to sow and in turn, the lender was paid back upon harvest. Thousands of years ago, the people of Mesopotamia invented the first form of currency called the shekel. The shift to coin was one of the first modifications in the history of money. Coins were one of the first currencies that allowed people to pay by count instead of weight, allowing trade to travel farther and with greater ease than livestock or harvest. After coins came paper money, then plastic cards, all in an effort to modernize convenience. From there, online payments developed with quick adoption and since then further transformation continued with digital currency allowing individuals to invest in potentially growing currencies and spend money in a way that’s more convenient and virtually borderless.

Cryptocurrency, also referred to as digital currency or crypto, is the mystical exchange of nothingness. Or is it? A cryptocurrency is a digital currency used as an alternative form of payment or investment. It uses encryption algorithms which serves as currency and a virtual accounting system. While some believe investors are tossing money into the void with nothing more than wishful thinking, others swear by the logic and freedom of being their own bank.

The rise of fintech and cryptocurrencies is shepherding in the next generation of finance. This new era is known for its ability to upset some of the existing intermediaries of the banking industry. Blockchain technology [a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain] and cryptocurrency could have the power to alter or even eliminate traditional banking entities from the borrowing/lending market. This power could also be used by fintechs as a means to sidestep existing issues in the current lending space, further outlined below.

Addressing Consumer Pain Points

In the crypto network, there’s no shortage of consumer promotion and mounting competition, which begs the question, is all the hype warranted? Here is a list of consumer pain points cryptocurrency addresses of which financial institutions should take notice:

- Inflation – Due to easily manipulated factors such as interest rates and debt, the US dollar no longer holds the value it once did, diluting the purchasing power of said currency.

- Fees (foreign exchange, insufficient funds, & transfer) – No longer will consumers be unreasonably charged for exchanging currency, fined for insufficient funds, or pay exorbitant surcharges to intermediaries offering their services to shift money from one account to the next.

- Timeliness – Real-time payments are in high demand. Basic wire transfers can take up to five days, and many find that clearing time to be unjustifiable.

- Ownership – The lingering threat of having your life savings seized or squandered is real for many. With crypto, owners are their own decisionmakers – they decide how, when, and how much to invest or trade.

- Inclusion – Banking the unbanked is a market many financial institutions have sought, but with great caution due to potential default liabilities. Whether due to infrastructure, paperwork, or location, 31% of the world’s population is not actively participating in banking.

Stay updated with our thought leadership resources: https://www.alliedsolutions.net/resources/allied-insights

How Financial Institutions Can Get Involved

Financial systems around the world are using or creating their own digital currency called Central Bank Digital Currencies (CBDC) and stablecoins [cryptocurrency designed to have a relatively stable price, typically tied to a commodity or currency or having its supply regulated by an algorithm], which can reduce the volatility risk that exists in crypto. Financial institutions have the opportunity to advantageously position themselves as partners in this global economic shift. Even if your financial institution chooses not to partake in this unique revolutionary variation of monetary exchange, it’s important to remain educated and in turn, educate your consumers. This is the time to demonstrate your knowledge in the crypto marketplace and meet them where they are. Analyze your consumers’ values, style, and needs, then connect with them in a way that is mutually effective and beneficial.

There are many offerings financial institutions can provide in relation to crypto but doing so should not be done casually. This endeavor requires in-depth research, from surveying your consumers to a diligent RFP process for service and technology partners with reliable analysis every step along the way.

Common crypto offerings currently include:

- Custody service – Financial institutions can offer custody services for cryptographic keys associated with cryptocurrency. This means safeguarding the private key that proves ownership of the funds within the crypto wallet, securing assets from theft.

- Trading platform – Trading or exchange platforms serve as centralized intermediaries allowing the consumer to trade crypto/digital currencies for other assets such as conventional fiat money [currency that is not backed by commodities such as gold or silver, and typically declared by a decree from the government to be legal tender] or other digital currencies.

- High yields – With regulation lacking, ambiguous lending by unidentified third parties, and no reserve requirements, depositors can earn annual percentage yields (APYs) more than 100 times higher on BlockFi [a cryptocurrency exchange and wallet that serves individuals and businesses worldwide] than on average bank accounts.

While the opportunities in this developing digital currency space are surely going to continue to advance, it is important to understand timing and the right fit for your financial institution. Though it may seem like digital currency has just recently debuted on the world’s financial stage, proposals for crypto offerings within traditional banking date back to 2012. Those offerings include things such as processing payments, providing escrow services, facilitating international cash transactions, helping consumers exchange cryptocurrencies, and making loans in digital currency. To be competitive in this market, you’ll need to be innovative and forward-thinking to get ahead.

In the next installment of our Sign of the Times blog series, learn about supply chain effects.

View Part 2 here: Supply Chain Economy: Framework for the Future

View Part 3 here: Banking for the Ages

Stay Informed on Resources from Allied Solutions: Join our e-newsletter list!