SIGN OF THE TIMES BLOG SERIES PART 2 — SUPPLY CHAIN ECONOMY: FRAMEWORK FOR THE FUTURE

The global supply chain has seen massive changes over the years. Advancements in technology changed business operations with respect to logistics and supply chain management including distribution, inventory management, and data collection. From rudimentary preindustrial handling to ocean trade vessels, and from innovative shipping containers to computerization and records management, global supply chains are more complex and more efficient than they’ve ever been.

Background

The term “supply chain” was only recently established as part of the globalization of manufacturing from the 1990s, however, its history dates back much further. In early times, transportation was basic with limited proximity. Goods were put together close to their raw source and maintained a rather direct distribution route to the end user. Given high costs and long-distances, trade was often limited to highly valuable items like spices, weapons, and luxury items. With more limited distances, sourcing, and engineering possibilities, disruptions were somewhat minimal. From early trade ships and the utilization of railroads to new technological shifts and mechanized processing, the supply chain has undergone life-changing developments allowing for an ever-expansive ripple.

More recently, the supply chain has been broken down into 5 basic steps:

- Planning

- Sourcing

- Manufacturing

- Delivery

- Return

Pretty simple, right? If you answered yes, you may want to reconsider. The standard supply chain definition and functionality tends to leave out one key element – the financial economy. Every step of the supply chain process results in a shift to the economies surrounding it.

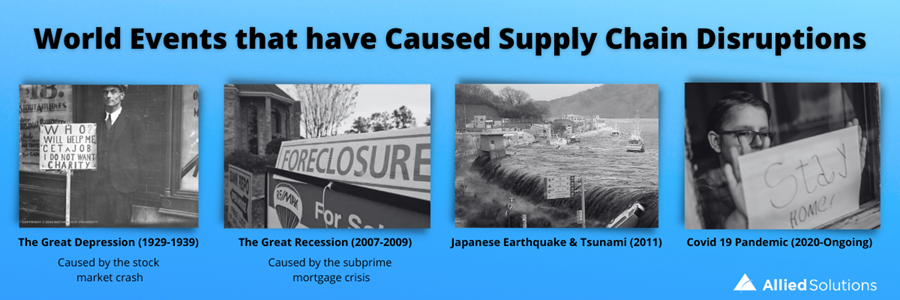

History has brought to light many shortfalls stemming from the silos that separate finance and the supply chain. A major weakness exposed by global events –The Great Depression (1929-1939) – derived from the stock market crash that charged its way to steep declines in industrial output. The same was true of The Great Recession (December 2007 – June 2009), which was caused by the subprime mortgage crisis. Natural events can disrupt the global supply, as it did with the Japanese tsunami of 2011. Japan's earthquake and the resulting tsunami created shortages to the world's supply of automobiles, electronics, and semiconductor equipment. Lastly, the world continues to experience long-term effects of major disruptions from the Covid19 pandemic.

At the beginning of the pandemic, businesses were left with billions of dollars in unsold goods. This caused inventory-to-sales ratios to surge momentarily before those inventories were liquidated. The ripples continued as the economy embarked upon its long road to recovery. As demand has increased, businesses have been unable to bring inventories fully back to pre-pandemic levels causing inventory-to-sales ratios to fall, which has then led to a bottlenecked supply chain and upward pressure on inflation.

A Call to Action for Supply Chain Management

With collaboration efforts, the financial economy and supply chains have an extraordinary opportunity to advance and overcome. This will undoubtedly be a heavy lift since these respective functions speak different languages, utilize dissimilar data, and leverage varying platforms. What will make all of this possible? Technology.

Silos are an anti-visionary plague to finance and any kind of meaningful developments to the world. To create reliable models, data needs to be accurate and uncompromised, thus reducing margin for error and lack of compliance, which would result in fragmented and unreliable plans to strategize for the future. An enterprise approach to analytics across product/service types and departments enables an accurate view into business opportunities, reducing squandered opportunities that have historically gone unnoticed.

It’s time to still the waters. There have been significant considerations for the supply and demand components of the equation, constant developments, and reinventing methodologies, but little attention has been paid to the improvement and analyzation of money flow. That’s all about to change as the convergence of finance and supply chains take shape. Doing so can reduce costs and maximize consumer value and competitive advantage. In times of lasting economic uncertainty, predictive forecasting is more critical than ever.

Moving Forward

Expect the unexpected. Planning will be crucial in mollifying the upheaving effects of supply chain disruptions. Integrating finance with supply is a new wave of innovation. Increased economic and rate volatility has many financial institutions rethinking their plans to meet objectives while managing the increased risk.

Financial institutions need to prioritize innovative methods for streamlining their financial distribution networks. Predictive modeling facilitates strategic optimization to pricing, product, portfolio, LP, and M&A performance with interactive economic scenarios, stress testing for reliable forecasts, managing capital, and bolstering compliance to new mandates from regulatory bodies.

Don’t be caught flat-footed. Leverage an integrated system to provide the solution you need to plan your moves forward with reliable and actionable intelligence.

Learn more by watching the webinar:

In the third and final installment of our Sign of the Times blog series, we’ll share how FIs can take a planful approach to bridging generational gaps.

View Part 1 here: Sign of the Times Blog Series Part 1: Banking Without Borders

View Part 3 here: Banking for the Ages

Stay Informed with Resources from Allied Solutions: Join our e-newsletter list!