Looking back over the last 12 months and saying “Wow, what a year” is equivalent to standing at your window on a rainy day stating, “Well, the grass needed this.”

Obvious, but true.

Historic natural disasters shook, flooded, swept away and shocked enormous parts of our country. A tempestuous political race flipped the script of the party taking the regulatory charge. Artificial intelligence capabilities exploded. Interest rates remained high. Vehicle affordability resulted in a record number of uninsured drivers.

And a partridge in a pear tree.

The resulting challenges don’t need to be rehashed: You have lived through them every day for the last year. You felt the weight a tough economy in the boardroom and in the bottom line.

And yet –

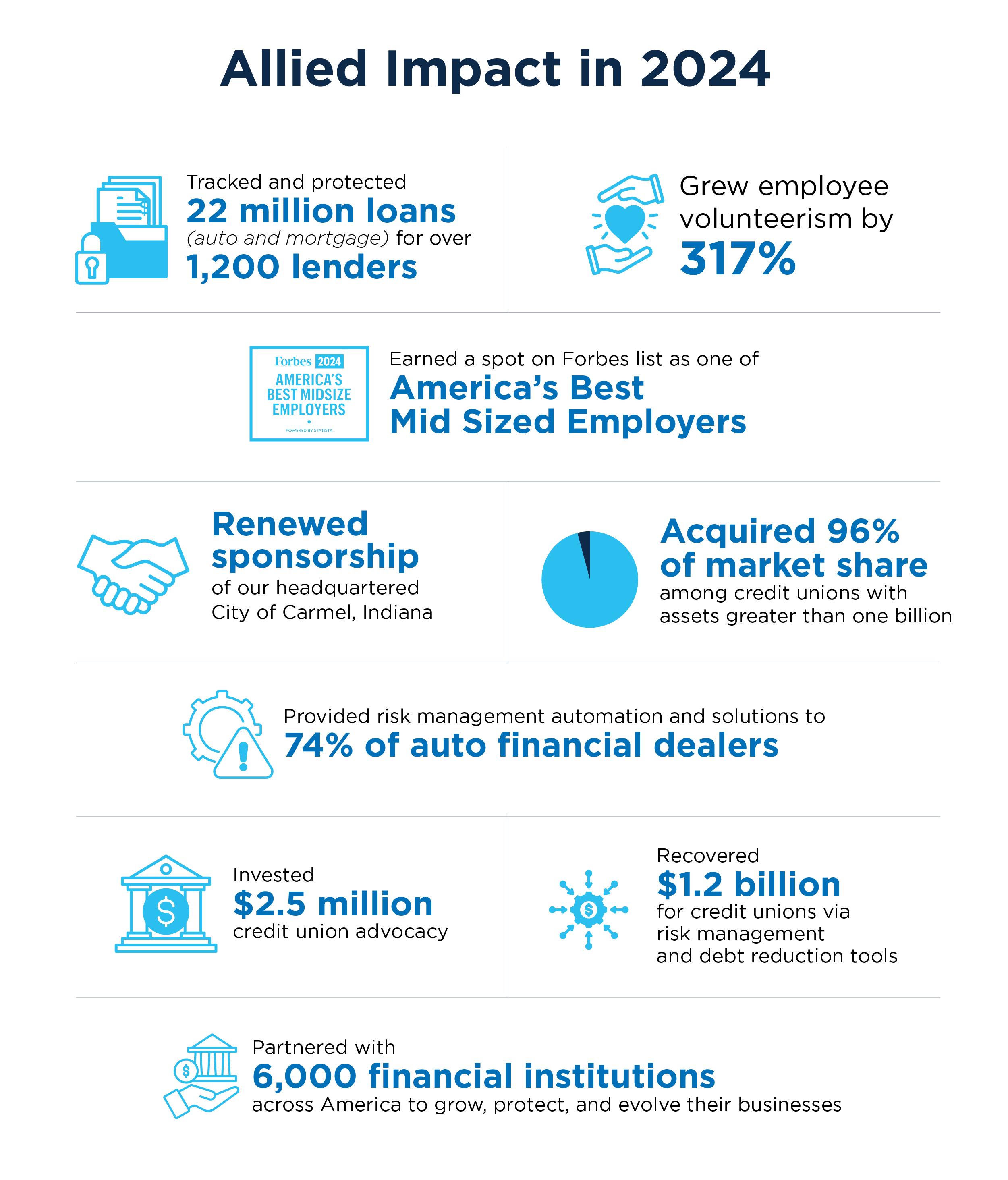

In the midst of these challenges, financial institution executives and lending institutions rose to the occasion, exemplifying agility and flexibility like never before. At Allied Solutions we are inspired by our financial institution partners and our commitment to serving you is stronger than ever.

Next Stop: 2025

At Allied Solutions, we are optimistic about the opportunities the new year holds. While 2025 offers a fresh slate, it comes with a few challenges penciled in from 2024. Based on what we're hearing, here are the trends on the horizon:

- AI’s explosive growth and expansive reach is inevitable. Financial institutions must continue to automate human-replicable operations. The less automation, the more opportunities for inefficiency, error, and poor member service.

81% of employees believe that AI is making them more productive and engaged.1 This belief is busing the myth of AI taking jobs. Automating both basic and complex business functions frees humans up to do new and better jobs. The time saved from using tools, like AI credit decisioning, will be used for other human-based projects.

As your institution implements more and more AI, it will become increasingly necessary to create guidelines for how employees use AI. As AI continues to touch nearly every area of our lives, it’s clear that digital transformation isn’t slowing down. - Move over Gen Z, here comes Gen Alpha. Credit unions have notoriously struggled to keep up with the digital demands of Generation Z (current ages 12-27) but Generation Alpha behind them could be their golden ticket to reviving the credit union mission. Who is Generation Alpha anyways? The oldest members of Gen Alpha are only 11 years old. They are Mini Millennials, as they are raised by the demographic cohort of big-bank-skeptic, budget-conscious, tech-savvy Millennials. As they come of banking age within the next few years, consider this your heads up to start tailoring your branding, messaging, and service options towards this digitally demanding generation. It’s time to capitalize on Generation Alpha. Learn their language now and take steps towards capturing this upcoming share of the market.

- The regulatory landscape is going to shift - again. We’re not saying that this one is set in stone (since it’s technically a prediction) but it’s very safe to assume that with administrative turnover in the White House there will be a regulatory trickle down.

The CFPB’s historic ramp up of regulatory scrutiny (especially around repossessions and ancillary product refunds) may shift to deregulation under a Trump administration. Lending scrutiny may become deprioritized at the Federal level, but the states are not scaling back on regulatory requirements for lenders.

On the cybersecurity front, digital banking brings new threats that need appropriate compliance and prevention measures. New tools, processes, and legal assistance to maintain compliance will all require more budgetary space. - Your portfolio may become largely uninsured. Inflation has led to a tight market Borrowers are struggling with vehicle affordability issues and a 30% increase in insurance premiums isn’t helping.2 As insurance premiums are becoming unaffordable, 28 million drivers are simply opting out and driving uninsured.3 Risk management strategies are shifting, and it’s crucial to know your unique ratio of uninsured drivers, and have proactive insurance coverage in place to holistically protect collateral.

Adapt to Excel in 2025

Over the last several years, the financial institution industry has flexed its adaptability muscles. Because of this conditioning, we believe there will be more positives than negatives in the new year. The financial institutions that adapt to the challenges of a new year, new demographics, and new regulatory environment will be the ones that excel. It’s not a matter of if you adapt, it’s how well you adapt.

Stay stable but agile, relevant and relatable with the right automation and industry expert guidance. Get frontline insights about evolving compliance and industry best practice responses from Allied Solutions.

We wish you a happy, successful New Year!

1https://www.zdnet.com/article/81-of-workers-using-ai-are-more-productive-heres-how-to-implement-it/

2https://www.autoremarketing.com/ar/analysis/soaring-auto-insurance-costs-a-big-problem-for-dealers-sales/

3https://financebuzz.com/uninsured-motorist-statistics-by-state