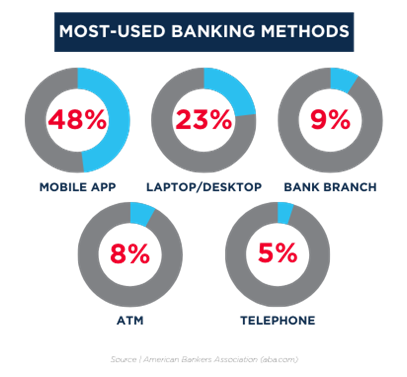

Digital banking became popular during the pandemic and continues to be positively received by consumers. A 2023 survey conducted by Morning Consult on behalf of the American Banker Association found that 71% of consumers are choosing to embrace the digital banking experience on both mobile and other online devices — with 48% of bank customers using apps on phones or other mobile devices as their top option for managing their bank account and 23% using online banking via laptop or PC. The next most popular banking methods include visiting a branch (9%), ATMs (8%) and telephone calls (5%). It is crucial for your institution to step into the space of digital technology to make banking more accessible and offer a better experience for customers.

In this article, we are going to talk about why your financial institution needs to focus on creating a digital business to improve customer experience, how becoming digitally optimized positively affects your employees and your business, and some recommendations on where to start or how to best continue your digital transformation journey.

Importance of Going Digital

Using digital technology gives institutions the opportunity to focus on higher-level goals and improve customer experience. Traditional banking methods are not as appealing to customers anymore and trends point to a future decline in financial institutions. In fact, just under 2,500 banks closed last year alone. Focusing on efforts that can reduce your chances of becoming a part of this statistic should be top of the list.

The closer to being fully digitally optimized that you can get, the better your institution’s chances are of thriving in an inevitable digitally dominated market. Digital technology is reshaping the way institutions interact with their customers. Implementing digital banking features offers customers greater convenience and a banking experience that is more personalized. Utilizing these digital offerings, financial institutions can better serve their customers and maintain competitiveness in a swiftly changing industry.

The New Employee vs The Old Employer

Staffing shortages are an ongoing issue. In April 2024, around 3.5 million people quit their jobs. COVID-19 changed the way people view work and how they want to do it. Between remote, hybrid, and in-office models, people have higher expectations for what they will accept from an employer. As financial institutions work towards implementing digital technology, it is important they are attracting talent with the skills to effectively utilize new technologies and digital applications while still being able to compete with other higher-level companies. Employees today prioritize working for an institution that provides autonomy, opportunities for career growth, and wellness offerings. If institutions fail to do this, they will lose high-level talent to fintechs or other innovative startups.

Improving efficiencies and processes helps to reduce the mundane tasks that can lead to employee burnout. Removing lower-level responsibilities, which can easily be done online or with the help of a tool, will not only give back valuable time to focus on higher-level tasks that can make them feel more fulfilled, but you are also giving your consumers (and those looking for a new financial institution) the remote self-servicing they are often seeking today.

Ready, Set, Go Digital!

As much as some might yearn for the way things used to be when it comes to managing their financial institutions, the reality is those days are gone. We are living in an ever-changing digital world and adapting is crucial for financial institutions to stay competitive and thrive. Thankfully, you do not have to do this all on your own and there is reason for great optimism. Thanks to technology and the ingenuity of software developers, there are tools that help make the digital optimization process faster and, in the end, can help your business run more efficiently, help you attract talented employees that are empowered to do their jobs, and in turn will improve the customer experience.

As promised, here are some recommended digital tools to help get you started or to keep you moving forward in your optimization journey.

- Digital Lending Platforms | Helps borrowers get approved for a new loan remotely

- AI Virtual Assistants | Call automation improves the customer service experience, increases revenue, and reduces costs

- AI Credit Decision Platforms | Instant loan decisions powered by artificial intelligence that can generate more approvals with lower risks

- E-Signature | Close loans more efficiently and conveniently with digital signing

- Text Solutions | From marketing to payment reminders to completing a transaction, texting offers on-the-go solutions

When it comes to being digital, time is literally money. Concentrating on getting digitally ahead, or even digitally caught up, can help the longevity of your institution by gaining new and sustaining current members and by presenting you as an attractive, potential employer while also empowering and freeing up the valuable time of your current employees.