Buy-now-pay-later (BNPL) is an upcycled layaway and it’s taking the e-commerce marketplace by storm. You’ve probably seen one of the top three names, Affirm, Klarna, and AfterPay, for buy-now-pay-later during an online checkout experience. As this credit service grows in usage, will other players join the marketplace?

Our prediction is a resounding yes.

Who’s Using BNPL?

Buy-now-pay-later gives online shoppers the option to put 25% of their purchase down and break up the remaining payment into smaller transactions over a set term.

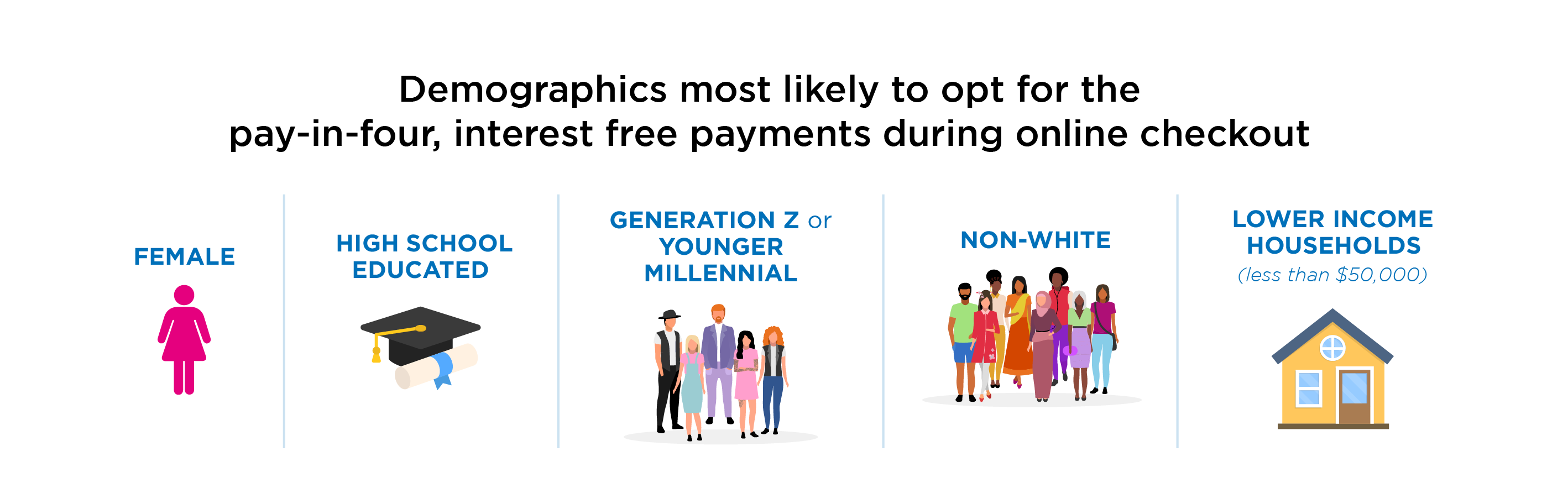

Because of the relative novelty of BNPL, the user characteristics are still forthcoming. However, there are some notable common threads of BNPL users (PDF download):

Why is BNPL so attractive?

BNPL entered the payment scene during the brief intermission of a pandemic and recession. There are a few key features that make BNPL financially attractive to online shoppers. Features like:

- Zero interest, for up to 6 months

- No hidden fees

- No credit checks

- Four or more easy-to-pay installments

- Spending flexibility for checkout

- Simple process with no loan application

Most alluring of all is that BNPL doesn’t involve so much as a soft credit pull. Think of BNPL as a credit ghost - it conceptualizes credit without affecting credit scores. For lower credit tiers, this fits the bill, literally. But is it a healthy form of credit for everyone?

For every pro there is a con.

The growth velocity of BNPL raises some concerns: Does this advance buyers’ financial wellbeing? Are borrowers educated enough to leverage BNPL in a responsible way and truly understand the terms of the agreement?

Without the proper education and mindset around BNPL, buyers can get into some budgetary trouble, purchasing items they cannot actually afford. This service could unnecessarily spur on rolling credit.

BNPL is advertised as interest-free. However, that’s only for a short-term. If buyers can make the installments within the zero APR term, they are good to go. However, after the 0% APR term (typically 6 months) is up, borrowers can be faced with up to 30% APR - much higher than an interest rate on a typical personal loan. This has regulators on high alert.

Hesitate to Regulate? Not the CFPB.

The CFPB has had their eye on BNPL for several years, considering buy-now-pay-later services a “loan”, and willing to apply traditional lending scrutiny to this service.

The Bureau conducted a survey and found that 6% of BNPL users have, on average, lower credit scores and a higher level of credit card indebtedness. It is no surprise that the Bureau is invested in protecting users of BNPL. Similar to product refunds on vehicle protection products, the CFPB is and will continue to take note if BNPL will positively impact borrowers over time.

Like any type of less-regulated transaction, there are also fraud concerns for financial institutions to consider.

Playing on the BNPL Playground

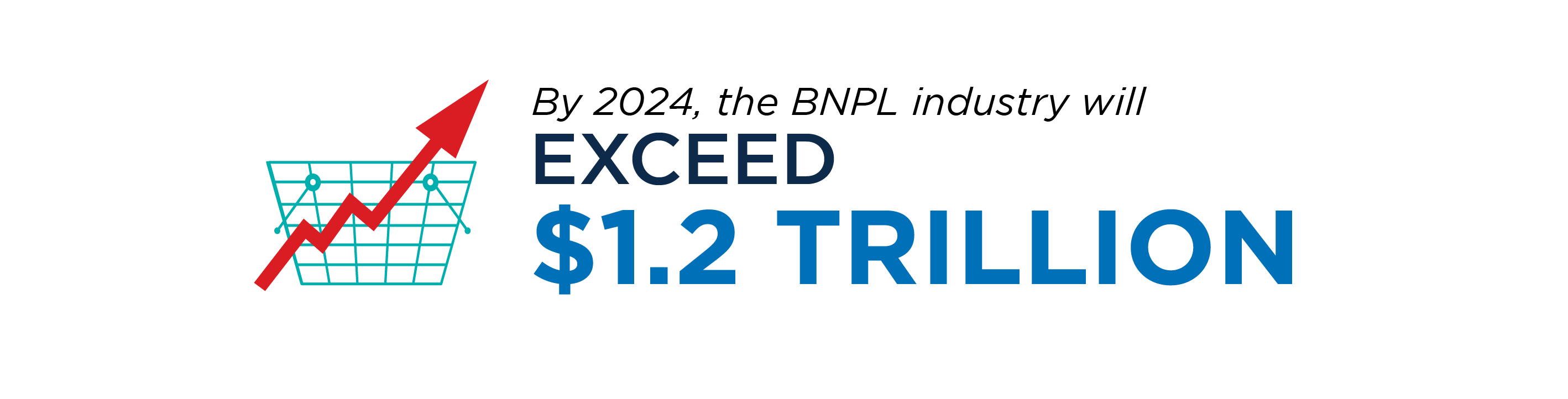

The BNPL industry will exceed $1.2 trillion by next year, so chances are, your cardholders are already doing BNPL. This indicates an enormous shift away from traditional lending. But financial institutions have an opportunity here: a positive opportunity to contribute to the narrative, not to mention, gain interchange revenue and deposit growth opportunities that could make up for reduced debit and credit card usage.

By partnering with a BNPL vendor that specializes in buy-now-pay-later transactions, financial institutions have a chance to play on the BNPL playground now. FI’s can bring safer transactions, fraud monitoring, and accountholder education to this space in a really tangible way.

The Bottom Line

BNPL’s proliferation is only getting started. Buy-now-pay-later is everything buyers want: transparency and convenience. It also offers gains for FI’s, so long as they maintain borrower sensitivity and fraud prevention best practices at the forefront.

Now is the time to start educating accountholders on how to leverage BNPL for their credit wellbeing. Strategize with a BNPL vendor partner to mingle regulatory compliance and user experience. Buy-now-pay-later isn’t a credit service to side-step. Be a part of the growth of the movement.