Let’s be blunt, talking cannabis business and banking is still often perceived as taboo by many but it should be far from off limits when considering risk amongst financial institutions. Part of the uncertainty around accepting, working with, and even discussing work with marijuana-related businesses (MRBs) is that this particular product is still considered illegal by the federal government, and while state exceptions may vary, they’re far from making this a joint decision.

Even though MRBs currently have limited banking power, it is still anticipated that sales will continue on a path of steady growth having MRBs rolling in the green. Growth predictions estimate legal marijuana sales to reach $30 billion by 2025.

As a point of clarification, generally there’s no difference between cannabis and marijuana, and the two terms are often used to describe the same thing. While cannabis describes cannabis products in general, marijuana specifically refers to cannabis products that are made from the dried flowers, leaves, stems, and seeds of the cannabis plant. For our purposes, we’ll be using the two terms interchangeably.

What are MRBs?

Viewing MRBs simply as an entity that has a direct connection with the product is an oversimplification. MRBs include entities that cultivate marijuana as well as processors, packagers, and anyone related to the transportation and dispensing of the product.

While these inclusions may cover many of the individuals involved in the MRB process, the tiered structure allows financial institutions to classify MRBs, while also determining the risk factors involved.

Here’s an outline of the three tiers of MRBs:

Tier I MRB

Tier-I MRBs are considered high-risk business ventures because they involve the most direct interaction with the product. These MRBs include, but are not limited to planting, cultivation, harvesting, processing, testing, packaging, transportation, and other related categories. These activities are typically licensed by state entities, but they also face more stringent compliance standards.

Tier II MRB

Tier-II MRBs as the name and placement suggest, are medium risk. These are characteristically supporting entities and may work directly with Tier-1 MRBs without directly interacting with the product. This tier includes packaging suppliers, associations, hydroponic suppliers, or even software providers. This tier can also include payment processors, consulting, advertising, and public relations services.

Tier III MRB

Tier-III MRBs are the lowest risk as they are further removed from the product, so are considered an incidental business. This categorization can be somewhat vague and open to interpretation, but Tier-III MRBs typically include accountants, lawyers, property owners, and other related business ventures.

The tiers are not only vital as a risk-assessment categorization but also as a guide to determine what additional compliance and review protocol may need to be implemented.

High risk, high reward; or, the higher the climb the harder the fall

Banking and cash management are extremely problematic in the marijuana industry. Due to the difficulty in obtaining financial services (including armored cars service) and because marijuana is primarily, if not exclusively, a cash business, MRBs deal with overwhelming safety, security, and operational issues. MRBs need access to financial services to survive and expand. A lack of relationship with financial institutions means that MRBs dealing primarily in cash can pose a threat including robbery and assault. This threat is then passed on through the business, its customers, employees, and vendors which could be prevented by allowing legalized marijuana businesses access to the federal financial system. Without banking support, MRB owners have several challenges to face:

- Unable to accept credit cards for payment

- Unable to invest through traditional means

- Paying everyday bills solely through money orders

- Safety concerns due to the volume of cash being carried

- No bank statements for reference

- Regular IRS penalties

This can be an attractive opportunity for banks and credit unions, provided they are ready to bear the risks of such an effort. The risks, however, are high and can, in some cases, pose an existential threat to financial institutions. The decision requires a great deal of scrutiny around the best and worst-case scenarios, such as finding your financial institution facing money laundering charges or costly BSA fines. Scenarios like that could ruin an institution and the careers of its officers.

The best-case scenarios could include:

- Increased revenue - The marijuana industry has endured great growing pains and the growth is continuous, as is the demand for banking services.

- New business partners - Financial institutions accepting MRBs as clients can form and increase business partnerships, ultimately growing their portfolios and expanding their customer base.

- Competitor differentiation - The cannabis industry affords financial institutions an opportunity to differentiate themselves in states where cannabis is legal.

However, competitive differentiation can cut both ways. In some communities, it would not be a competitive advantage to be associated with MRBs, financial institutions need to consider their existing customer base and service area when deciding whether to pursue this business case. These challenges can seem intimidating, but with careful planning, thorough risk-mitigation strategies, and extensive monitoring it is possible to provide financial services to the cannabis industry.

You can’t spell healthcare without “THC”

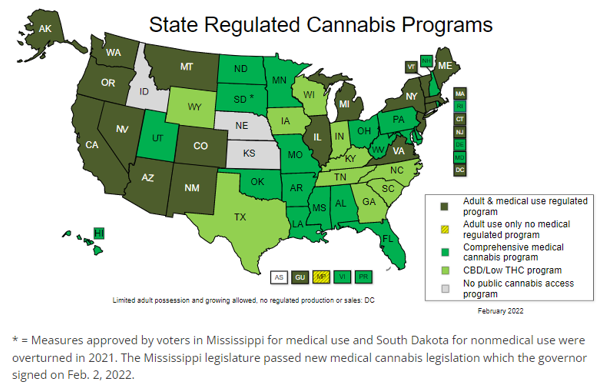

While marijuana is still illegal under federal law, a growing number of states have legalized the drug for medical or recreational purposes. The changing legal landscape has matched that of the dramatic increase in public support for legalization.

There are currently 37 states that regulate cannabis for medical use by qualified individuals. In addition, 11 states allow the use of "low-THC, high cannabidiol (CBD)" products for medical reasons in limited situations. Low-THC programs are not counted as comprehensive medical cannabis programs.

February 3, 2022: This map DOES NOT reflect the Mississippi legislation signed on Feb. 2, 2022. It will be updated soon.

Sourced from NCSL (National Conference of State Legislatures)

If your state has legalized a form of marijuana, you should expect a new or rising crop of cannabis-related businesses to take root that will require banking services. Regardless of your financial industry’s decision to bank or not bank, it’s important to understand the activities, risks, and requirements associated with marijuana-related businesses if your field of consumers includes these business owners.

Click here to view the NAFCU panel discussion in which Allied’s Patrick Touhey explains the intricacies of cannabis business, the growing market demand, and ways CUs can address the risks and regulations.

Allied's latest program gives Allied access to place Cannabis Directors & Officers (D&O) Liability protection for credit unions and banks. We are prepared to offer this in states where cannabis has been legalized by the state, except in Washington. If you have further questions about this program, contact Patrick Touhey, Brandon Bottomley, or Mark Chapman.